Analysts at QuoteWizard looked at data from The Commonwealth Fund to see where residents are paying a larger share of their income towards health insurance premiums and deductibles.

Key findings:

- Nearly 32 million workers (21% of the U.S. workforce) would benefit from raising the federal minimum wage.

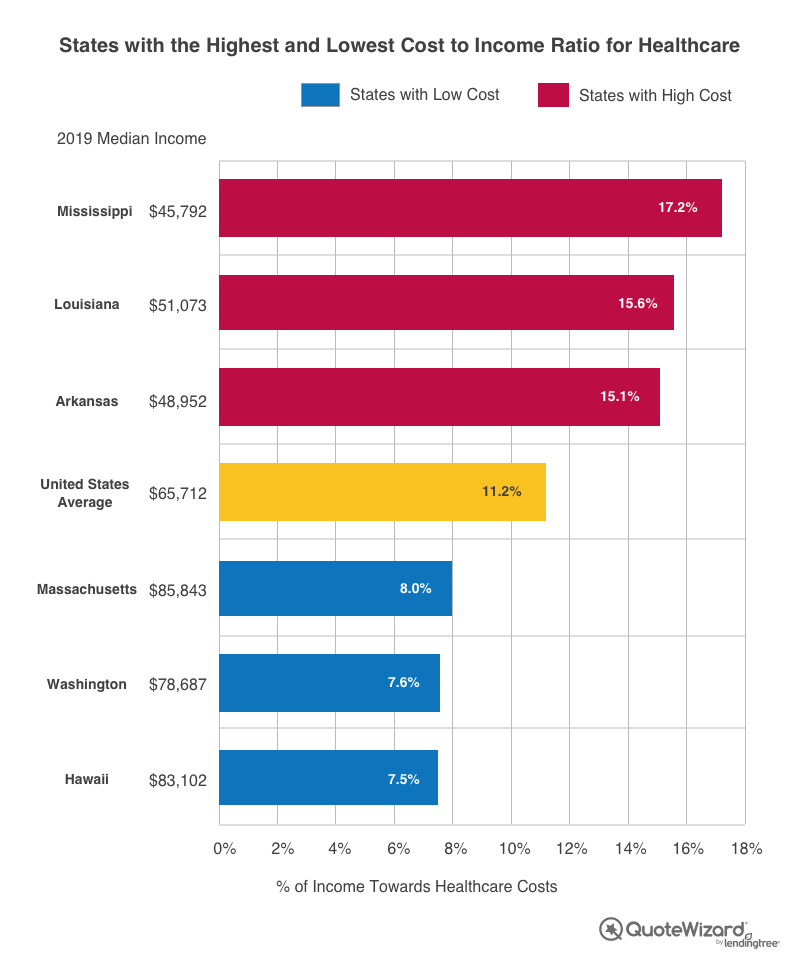

- Workers in Mississippi, Louisiana and Arkansas contribute, on average, the highest percentage of their income to out-of-pocket health coverage costs.

- In Hawaii, Washington and Massachusetts, the middle class contributes the least of their income towards health premiums and deductibles.

- Forty-two states contribute more than 10% of their incomes towards out-of-pocket health costs.

- Nationally, those with middle income pay $7,388 yearly in deductibles and health premiums combined.

By the end of 2021, a total of 25 states are expected to increase the minimum wage. These states will be the first to respond to the call for livable wages, aiming to bring low-income families out of poverty. As President Biden said in his recent speech, “No one working 40 hours a week should live below the poverty line.”

Recent trends in health care costs, health care coverage and household income have contributed to growing disparities between different income groups in the United States. The adoption of the Raise the Wage Act of 2021 would ultimately narrow racial and gender pay gaps and help those most affected by minimum pay such as women, minorities and frontline workers. A gradual rise in the federal minimum wage to $15 by 2025 would increase pay for nearly 32 million workers — 21% of the U.S. workforce.

Analysts at QuoteWizard looked at data from The Commonwealth Fund to see where residents are paying a larger share of their income towards health insurance premiums and deductibles. Factors we looked at:

- Each state’s yearly median household income in 2008 and 2019

- Employee-sponsored insurance premium costs in 2018 for a single person and family

- Employees’ combined out-of-pocket contributions to yearly premium and deductible costs

Middle-class income and health care costs

States that had the largest median wage increases over the last decade paid the least in combined deductibles and premiums in 2018. Washington State experienced the second-largest median wage increase (35.5%) from 2008 to 2019, while its residents pay nearly the lowest out-of-pocket costs for health care (7.6% of annual wages). Colorado, Utah, California and Massachusetts were also in the top ten of both highest wage increases and ranked in the bottom ten for out-of-pocket premium and deductible costs.

On the contrary, Mississippi, Louisiana and Arkansas residents experienced the lowest median wage increases in the country while paying the most in out-of-pocket health costs — between 15% and 17% of their income. These residents pay the most of their income towards combined annual premiums and deductibles. Rising deductibles in low-income states leave many underinsured, causing them to skip their care because of higher costs. A person is underinsured when the average deductible is more than 5% of their annual income, according to The Commonwealth Fund.

On the contrary, Mississippi, Louisiana and Arkansas residents experienced the lowest median wage increases in the country while paying the most in out-of-pocket health costs — between 15% and 17% of their income. These residents pay the most of their income towards combined annual premiums and deductibles. Rising deductibles in low-income states leave many underinsured, causing them to skip their care because of higher costs. A person is underinsured when the average deductible is more than 5% of their annual income, according to The Commonwealth Fund.

The top 10 states whose residents pay the largest portion of their income towards out-of-pocket health insurance costs increased their median wages by an average of $10,615 from 2008 to 2019. The 10 states whose residents pay the least amount of their wages towards health care costs increased their median incomes by an average of $17,028. Additionally, as of 2019, the states with the highest out-of-pocket health care costs had a median income of $54,679, while the 10 states whose residents paid the least out of pocket earned a median income of $80,104.

Nationally, a middle-income person pays an average of $4,396 towards yearly health premiums and $2,992 on deductibles, adding to a combined average total out-of-pocket cost of $7,388 per year.

Forty-two states contributed more than 10% of their incomes towards out-of-pocket health costs in 2018, compared to only seven states in 2008. Health care costs are increasing at a faster rate than wages. As of 2018, 11.2% of middle-class wages go to out-of-pocket health coverage costs, and the trend could likely continue if wages remain stagnant and health care costs increase. As wages increase, so do employer premiums and deductible contributions, thus putting less burden on employees.

Ranking Disparity of Middle-Class Income and Health Insurance Costs

| Rank | State | 2019 average household income | Out-of-pocket premiums and deductible cost | Total % of income towards healthcare costs per year |

|---|---|---|---|---|

| 1 | Mississippi | $45,792 | $7,864 | 17.2% |

| 2 | Louisiana | $51,073 | $7,951 | 15.6% |

| 3 | Arkansas | $48,952 | $7,402 | 15.1% |

| 4 | South Dakota | $59,533 | $8,621 | 14.5% |

| 5 | Kentucky | $52,295 | $7,470 | 14.3% |

| 6 | Tennessee | $56,071 | $7,966 | 14.2% |

| 7 | North Carolina | $57,341 | $8,091 | 14.1% |

| 8 | Arizona | $62,055 | $8,364 | 13.5% |

| 9 | Oklahoma | $54,449 | $7,312 | 13.4% |

| 10 | Florida | $59,227 | $7,925 | 13.4% |

Methodology:

To find out which states have the largest disparities between middle-class income and out-of-pocket health insurance costs (premiums and deductibles), QuoteWizard analyzed The Commonwealth Fund’s state-by-state report on “Insurance Costs Taking Larger Share of Middle-Class Incomes as Premium Contributions and Deductibles Grow Faster Than Wages.” We compiled 2019 employee contributions to yearly health insurance premiums and average deductible costs and compared them to each state’s median income. Median middle-class income data was sourced from the U.S. Census. States with the highest average percentages of income that go to out-of-pocket health insurance costs are ranked closer to 1 (worst) and states that had relatively lower health insurance costs compared to income ranked closer to 50 (best).

–prnewswire.com